As we begin the year, community managers, board members and insurance brokers are still taking deep breaths to recover from the fast and furious insurance market we had in 2023. Many Community Managers had to incorporate major rate increases in their 2024 budgets. Most board members had a hard time approving these increases with very limited time and options. The participation of insurance brokers in board meetings and town hall meetings became critical in helping to control and mitigate this insurance crisis.

Key factors in 2023

- Reinsurance: By the same manner that community associations buy insurance to protect their buildings, insurance companies also need to buy insurance to be able to pay for claims. Most carriers enter into reinsurance renewal agreements twice a year, January 1st and July 1st. In addition to rate increases, these agreements have also resulted in new underwriting guidelines and capacity restrictions in the last four years. This means that for reinsurers to back up insurance companies, a very limited amount of coverage will be available subject to very specific criteria (age of building, type of construction, building limit, loss ratio, etc.) You could say that reinsurers dictate the rules of the game and insurance companies have to enforce those rules to maintain their reinsurance agreements. The insurance brokers’ role is to keep board members and community managers informed about how the rules of the game are changing so they can budget properly. In 2023, the biggest challenge was that reinsurers deployed less capacity and imposed stricter rules, sometimes impossible to meet especially for aging communities.

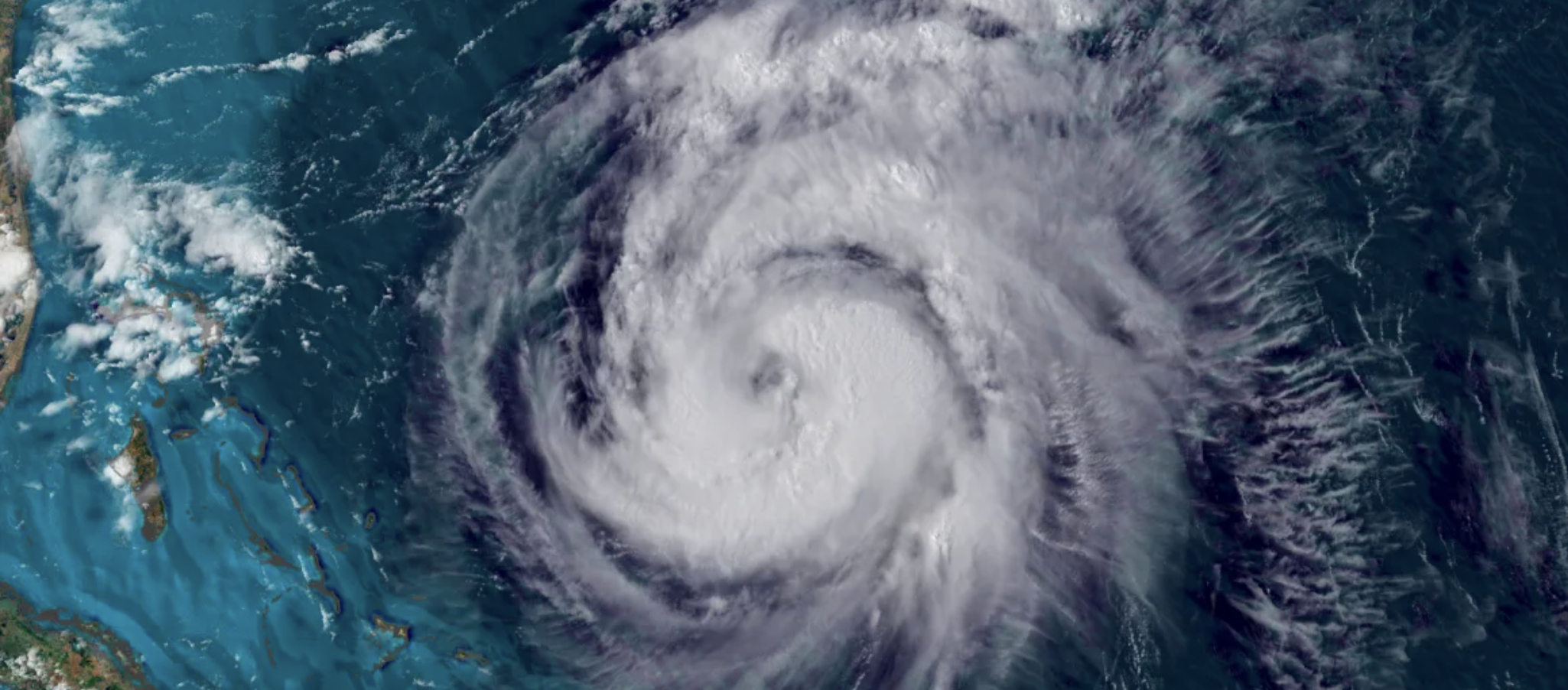

- Billion Dollar Natural Disasters: In the insurance world we refer to this as CAT exposure, which is catastrophic losses such as hurricanes, wildfires, and floods. Unfortunately, there has been an increase in the frequency and severity of these events, especially in California and Florida, in the last 5 years. According to the State of the Market report published by Amwins in October of this year, 2023 marks the 16th consecutive year with insured U.S. severe convective storm losses topping $10 billion dollars. “Through the end of September 2023, there have been 24 confirmed weather or climate disaster events in the US with losses exceeding $1 billion. This puts the U.S. on pace to exceed any prior annual record number of billion-dollar disaster events.” Even though community associations in the DC metro area are not directly exposed to these disasters, they are directly impacted financially because their coverage comes from the same insurance pool.

- Rising Property Values: The increased cost of construction, the supply crisis, and labor shortages were still a major factor in 2023 from an insurance perspective because of the need to adjust building valuations based on the current cost to repair or rebuild in today’s dollars. Another factor is the insurance requirements from an association’s governing documents and from Fannie Mae, buildings need to be insured at 100% replacement cost, and this is non-negotiable.

A few years ago, insurance companies were renewing policies for the same valuation for consecutive years and were only applying a rate increase. However, this year there has been a substantial increase in rates as well as adjusted valuations. This is not to be confused with market value. Many communities are seeing valuation increases between 10% to 25% or even higher if these values have not been adjusted periodically. These adjustments are strongly enforced especially by insurance companies that are writing coverage enhancements such us Extended Replacement Cost of 150%, 200% or Guaranteed Replacement Cost. When a board refuses to accept the proposed increase in the replacement cost of a building, the underwriter will most likely apply a coinsurance penalty which will result in a reduction of premium. However, the community will immediately disqualify from new Fannie Mae insurance requirements as coinsurance provisions are not accepted.

What to expect in 2024?

While supplies remain limited and the cost to repair or rebuild increases, the need to increase property values will continue to increase. The fact that higher values are needed while lower capacity has been deployed is exacerbating the current market conditions.

As a result, some insurance companies have decided to exit the market and the remaining carriers have been obligated to tighten their underwriting guidelines. There has been a significant increase in the number of cancellations or non-renewals issued by insurance companies. Underwriters are now scrutinizing the Construction, Occupancy, Protection and Exposure of every single property they renew. In the insurance industry we refer to this as the COPE.

I highly encourage board members and Community Managers to become familiar with their association’s COPE to be able to anticipate any potential cancellations and budget for renewal increases. An association that is cancelled by their insurance company will most likely need to take coverage from the non-admitted market. This change will easily generate a premium increase between 100% to 450% with deductibles that range between $50,000 to $250,000.

While each insurance company has its own guidelines, below are the most typical factors that are currently triggering cancellations:

"Our Board Just Inherited a Host of Old Violations - What Should We Do?"

"Our Board Just Inherited a Host of Old Violations - What Should We Do?"